After 10 years in business ShipBob has announced their intentions to go public within the next year at a $4B valuation. That seems like a stretch unless they look at making a few key changes.

The Evolution of ShipBob

In 2014 Divey Gulati and Dhruv Saxena initially set out to create a software company. Their goal was to help e-commerce shippers manage their own operations by making label printing a little easier. They gradually expanded into picking up packages for their customers and eventually their customers asked them if they’d be willing to just hold their inventory and take care of all of this logistics stuff. Thus ShipBob was born.

This pivot from a basic service to an end-to-end fulfillment solution underscored a significant evolution. Starting from Dhruv’s Chicago apartment, ShipBob has impressively expanded to over 39 fulfillment centers in the US and 9 international locations showcasing its aggressive growth, particularly during the pandemic era.

ShipBob has raised a lot of money as well. Over $331M across 9 funding rounds to be exact with the most recent being a $200M Series E in 2021 led by Bain Capital Ventures at a $1B valuation on an estimated $215M in revenue on the heels of their first profitable quarter in Q4 2020.

The pandemic gave ShipBob, like many other fulfillment companies, the opportunity for tremendous growth. Their physical locations grew from 10 in 2020 to 24 in 2022, but probably the most impressive thing that they did was in the partnerships arena. They are Walmarts preferred TwoDay delivery partner. They are Shopify Plus’s only certified global fulfillment partner. They allow brands to completely offset their carbon emissions via Pachama. In late 2023 they became TikTok shops preferred fulfillment partner, and in early 2024 they became one of the first (if not the first) fulfillment center to offer Amazon Logistics as a delivery service.

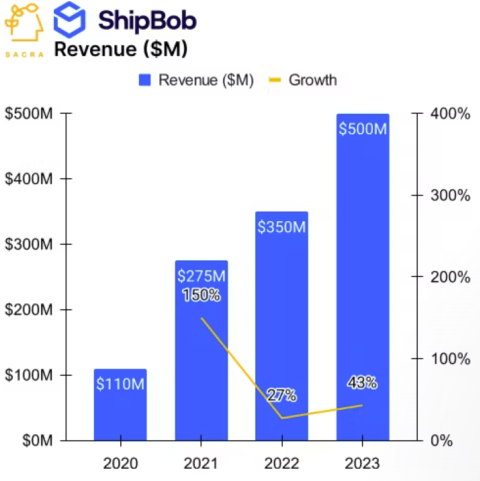

Their revenue has increased dramatically as a result, although it’s rumored that they still may not be profitable.

Their impact on the industry

ShipBob’s impact on the logistics and fulfillment sector is undeniable.

If you google anything related to ecommerce fulfillment, chances are they are either bidding on those keywords, have one of the top websites, or in most cases both.

They have onboarded and oriented thousands of brands to what it looks like to work with a 3rd party fulfillment provider which made life much easier for other fulfillment providers when those brands churned out.

In an era where most fulfillment software, to put it mildly sucked, and where ecommerce sellers were used to the UI/UX of Shopify, Klayvio, and Flexport their proprietary WMS put all other fulfillment companies on notice and they’ve been playing catch up.

There’s a lot to like here and I would be thrilled for their team and the ecosystem if they got it, but I don’t see them sustaining a $4B valuation.

A Tough Sell

When a company enters the public domain, it is voraciously analyzed and compared to its peers and valuations are reset on a daily basis based on their actual performance, not based on a compelling dream or vision. So let’s take a look at a few comparisons.

ShipBob’s revenue is estimated to be in the ballpark of $500M in 2023 which is up from $350M in 2022 largely thanks to the Tiktok shop deal. It’s unclear if they are profitable at all.

If we use another pure play warehousing company like GXO as a comparison ($6.7B market cap, $9.7B in revenue, $755M in profit) then Shipbob would need to be generating a profit of around $450M to justify a $4B valuation.

I think the most difficult and longer term challenge for ShipBob though is its current client base. They proudly claim 7000 brands as customers, many for whom ShipBob is the first 3PL they’ve worked with. Despite the impressive number of logos, only a relative few account for the majority of their revenue and many of their brands churn out after about a year. Compare that to GXO who almost exclusively works with large enterprise clients.

How they can get $4B

The reality is that ShipBob today is kind of a tough company for investors to nail down as they have very different business lines .

- They are a fulfillment company in the sense that they hold inventory and ship it out on behalf of customers

- They are a WMS provider in the sense that they’ve built a proprietary software and are now offering it to other warehouse companies

- They are a 4PL freight forwarding company in the sense that they offer end to end logistics from Factory to warehouse for their clients via larger players in the ecosystem

- They are a real estate company in the sense that they own most of their buildings

- They are an operations integration layer by maintaining one click integrations with fulfillment software, shippers, planning software, marketing, finance, and packaging solutions.

If I were to wave a magic wand, here’s what I think they need to do to maximize their valuation.

- Split up their business into 3 entities before filing for an IPO: a supply chain tech company, a 3rd logistics company, and a real estate company. They can still wholly own them for now, but they’d be able to attract investors who are only interested in those businesses.

- Slim down their 3PL operations to only focus on the types of customers that are profitable for them. Today I’m seeing the best 3PLs sharpening their ICPs and culling their portfolio to make things fit better operationally. I would imagine that this means encouraging most of their smaller brands to leave and consolidating locations.

- Continue to lean into their integrations and encourage more brands to use their software without their fulfillment services.

They missed their Exit

The best possible outcome for ShipBob would have been an acquisition by Shopify who was reportedly in discussions with the company in 2022.

This acquisition would have been a great one for Shopify as well. They would have gotten a robust WMS and software tech stack and an extensive bolt on physical infrastructure that would have been a major step forward for Shopify Logistics strategy at the time.

However, the promising union between Shopify and ShipBob stumbled upon the hurdle of valuation. Reports suggest that ShipBob’s valuation expectations were beyond what Shopify was willing to pay. Instead Shopify opted for asset light provider Deliverr for $2.1 billion which makes you wonder how much more ShipBob was asking for– maybe they’ve had $4B written down on a piece of paper for a while now.